tax loss harvesting rules

On the first day of the. Ad Put our asset allocation portfolio construction and manager selection expertise to work.

Turning Losses Into Tax Advantages

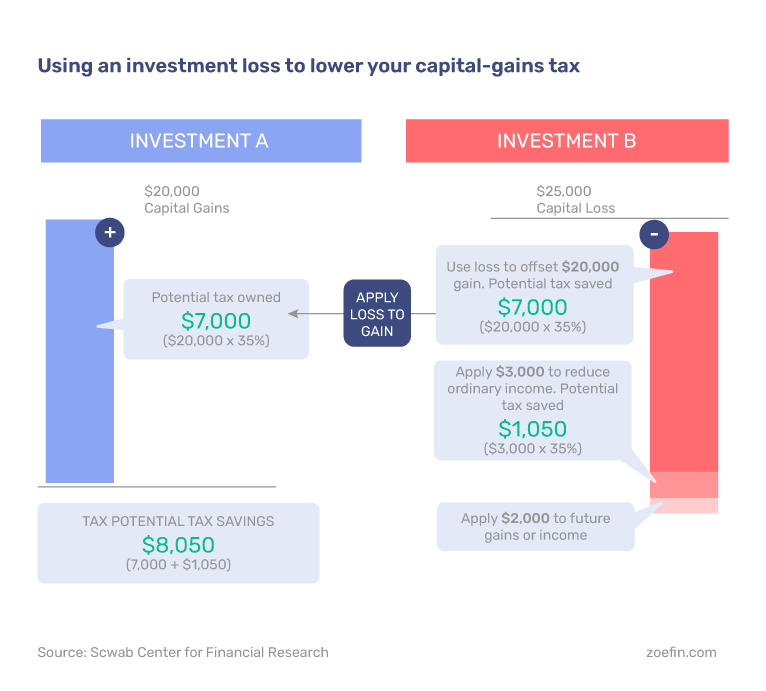

By realizing or harvesting a loss investors can offset taxes on gains and income.

. You can only do tax-loss harvesting in your taxable brokerage accountsnot in 401ks or IRAs. Here are three things youll want to watch out for as you use this tax break. But theres a silver lining.

I have large losses on my companys stock. Tax-Loss Harvesting Rules 1. Tax loss harvesting consists of three steps.

You have now booked a total loss of 72822. Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. While implementing the strategy of tax loss harvesting the following rules should be kept in mind.

Tax-loss harvesting works by selling shares for a loss to offset gains to lower capital gains tax owed. Per the IRSs netting. In taxable accounts when you sell a position that has lost value you can use the loss to offset capital gains that result from selling securities at a profit.

When done without regard for the clients bigger picture tax-loss harvesting is as likely to have a negative outcome for the investor as a positive one. Given a 32 federal tax bracket and a 5 state tax bracket youve now saved yourself 72822 032005. The strategy known as tax-loss harvesting allows you to sell declining assets.

The chance to turn losses into tax breaks as long as you follow the rules. There are some rules to keep in mind. Of course the IRS has some.

Ad Aprio performs hundreds of RD Tax Credit studies each year. While implementing tax loss harvesting the capital loss. Rules of Tax Loss Harvesting.

Help your clients reduce tax risk while maintaining market exposure. Some investment accounts like your 401k 403b or IRA are tax-advantaged. Three things to watch out for when harvesting a loss.

Easily manage tax compliance for the most complex states product types and scenarios. Partner with Aprio to claim valuable RD tax credits with confidence. Easily manage tax compliance for the most complex states product types and scenarios.

Tax-loss harvesting rules to know You wont find any specific reference to tax-loss harvesting in the 45000 words the IRS devotes to investment income and expenses in. Start wNo Money Down 100 Back Guarantee. First you need to estimate your current capital gains for the year and.

Thus in that case tax-loss harvesting has reduced the net LTCG tax payable liability by Rs. Federal government allows investors to. Tax-loss harvesting is the practice of selling an investment for a loss.

Ad Honest Fast Help - A BBB Rated. Crestmont is not a CPA firm or tax advis. You have to use short-term losses to.

Analyze and customize this portfolio or any other on our models resource center. I have a large block of RSUs vesting this week and the tax setting is to sell vesting shares to cover tax. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

The AIA SP 500 Cash Funded After-Tax Composite seeks to track the SP 500 index on a pre-tax basis while using loss harvesting and tax management techniques to. To do it you simply need to lock in a loss by selling the. As with any tax-related topic there are rules and limitations.

Master Property Tax Guide 2021. Ad Offers Comprehensive Explanations Of Topics Often Researched By Tax Professionals. Tax-Loss Harvesting Rules or principles.

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end. Discover The Answers You Need Here. How to tax loss harvest.

Your investments need to be in a taxable investment account. Follow Tax-Loss Harvesting Rules. RSU Wash Rules and Loss Harvesting.

The Nations Top Federal Tax Resource US. Ad Accurately file and remit the sales tax you collect in all jurisdictions. Overview of tax loss harvesting how it can reduce your overall tax liability rules and regulations to be aware of.

Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the. Learn how it works and its rules benefits limitations and more. Ad Over 25 years of offering tax-managed investing solutions to advisors and their clients.

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Definition Example How It Works

Year Round Tax Loss Harvesting Benefits Onebite

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

How To Choose The Best State To Retire In

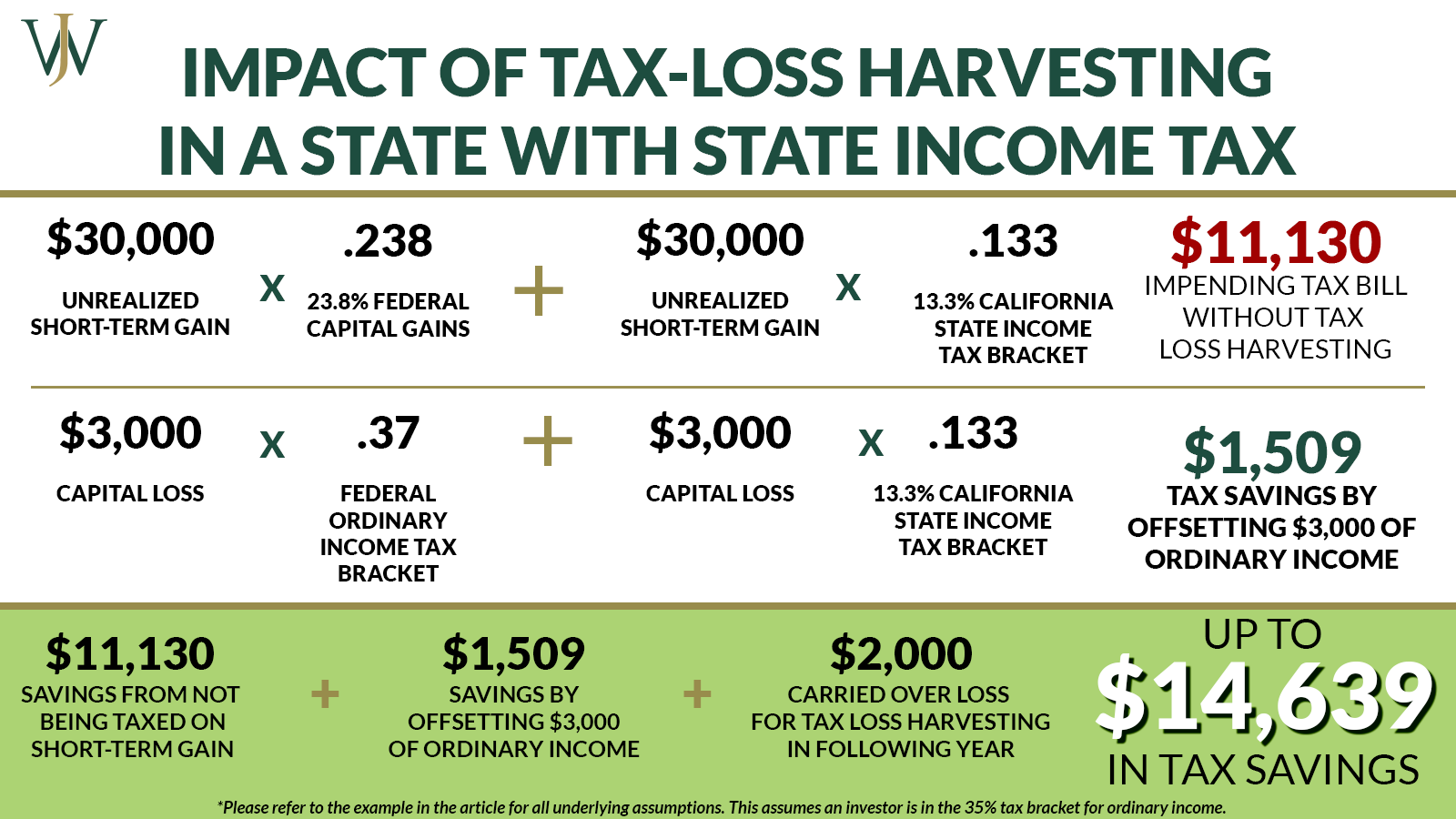

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Reap The Benefits Of Tax Loss Harvesting

Do S And Don Ts Of Tax Loss Harvesting Zoe

Tax Loss Harvesting Napkin Finance

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Napkin Finance

What Is Tax Loss Harvesting Ticker Tape

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Everything You Should Know

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital